Mission

Shared Interest mobilizes the resources for Southern Africa’s economically disenfranchised communities to sustain themselves and build equitable nations. The project will help women entrepreneurs and smallholder farmers multiply and distribute climate-resilient, protein-rich legume seed to increase farmer productivity and improve livelihoods.

Life Challenges of the Women Served

Quality seed is one of the most fundamental requirements for productive agriculture. In Malawi, seed is not only unaffordable, it is often unavailable. Traditional crops, especially legumes like soya, groundnuts, cowpeas, and beans, which have historically been grown mostly by women, are not financially lucrative for seed manufacturers and are neglected by the market. Farmers who seek these varieties are frequently unable to find them at a fair price or at all. The dire shortage of quality seed contributes to ongoing poor agricultural productivity, malnutrition, and soil degradation.

Quality seed is one of the most fundamental requirements for productive agriculture. In Malawi, seed is not only unaffordable, it is often unavailable. Traditional crops, especially legumes like soya, groundnuts, cowpeas, and beans, which have historically been grown mostly by women, are not financially lucrative for seed manufacturers and are neglected by the market. Farmers who seek these varieties are frequently unable to find them at a fair price or at all. The dire shortage of quality seed contributes to ongoing poor agricultural productivity, malnutrition, and soil degradation.

This problem affects Malawian smallholder farmers, particularly women, who have traditionally cultivated and sold legume crops. When a farmer plants poor quality seed, she is rolling the dice. The seed may not germinate at all, resulting in devastating total crop loss. Or it may perform poorly, depressing her yields and thus her income. Poor quality seed plays a meaningful role in the subsistence agriculture ‘trap’ that prevents many Malawian farmers from lifting themselves out of poverty. Families are affected as well. Most Malawian women hold back a portion of their legume harvest for home consumption, as these nutrient-dense crops help fortify their families’ maize-heavy diets. The low yields caused by poor quality seed may force families to sell their entire harvest in order to have enough money for necessities, resulting in a deleterious effect on household nutrition. A full 84 percent of rural households report having food insecurity at least one month of the year. Eighty percent of Malawians live in rural areas.

A full 84 percent of rural households report having food insecurity at least one month of the year. Eighty percent of Malawians live in rural areas.

Malawian smallholder farmers are widely affected by this problem. Less than 25 percent of farmers are able to use certified seed. The bulk of available certified seed is actually hybrid maize. For all other crops, it is estimated that more than 90 percent of smallholder farmers rely on informal markets or farm-saved seed, often resulting in seed of questionable quality and poor performance. For instance, Rhoda Banda is a farmer living in Kasungu district, Malawi, who is working with African Women in Agribusiness. This year she was only able to purchase enough certified soybean seed to plant one acre. On the rest of her land she used saved seed. She does not know how much income she lost by planting this inferior quality seed – but she does know she needs to pay school fees for her three children, and she is praying that the harvest will be sufficient. She is relieved to know that next year she will not have this problem again.

Several factors contribute to the current situation. The seed market is an oligopoly, with the top four players, all multinationals, sharing a combined market share of 94 percent. These companies focus on maize to the detriment of other crops, because maize production is incentivized by the government’s Farm Input Subsidy System (FISP). FISP provides some farmers with vouchers that can be exchanged for heavily subsidized maize seed. The government then pays a pre-determined price for each voucher. Roughly 70 percent of the seed sold in Malawi is purchased by the government in this way. With FISP as their primary customer, seed companies make huge profits on every seed sold for which they own the intellectual property. They have little reason to produce other crops, especially local varieties of traditional crops grown by women, for which they do not own intellectual property and cannot earn a royalty. Local seed varieties, developed by research institutions, often outperform commercial varieties in Malawi’s climate and disease context and are better for local farmers and food security for Malawi, but are rarely scaled to meaningful production levels because of the lack of financial incentive to do so.

Local seed varieties, developed by research institutions, often outperform commercial varieties in Malawi’s climate and disease context and are better for local farmers and food security for Malawi, but are rarely scaled to meaningful production levels because of the lack of financial incentive to do so.

Community-based seed multiplication programs by smallholder farmers have been able to produce quality seed at affordable prices. However, these projects have not managed to become sustainable, largely due to lack of access to credit. This shortage of capital has prevented smallholder seed enterprises from scaling to competitive sizes, investing in storage and distribution, and forming the management and governance structures needed to operate independently and professionally. Instead, in almost all Southern African countries, multinationals have a lock on the formal seed market, smallholder farmers are excluded, and access to seed is far more limited than it should be, depressing productivity and income for poor families.

The Project

Shared Interest’s Seeds of Resilience project addresses the shortage of legume seed in Malawi by creating a seed production company owned by women entrepreneurs, African Women in Agribusiness (AWAB). AWAB will distribute seed to thousands of mostly female smallholder farmers, directly improving their productivity, drought resilience, household nutrition, and incomes. AWAB will be a community-based entity operationally and financially sustainable and equipped to compete against the dominant players in the market. This means that a new, larger supply of seed will continue to grow and flow into farmers’ hands long into the future. For the first time, smallholder farmers will be able to participate in – and profit  from – the formal seed production system. AWAB and its growers will plan the quantities and varieties of seed to produce based on the needs of farmers in their communities, ensuring that local voices are directly represented in food systems. AWAB will contract with 1,310 smallholder growers, 920 of whom are women, to produce the seed, which sells at an average 500 percent premium to grain, providing these farmers with a reliable, living income.

from – the formal seed production system. AWAB and its growers will plan the quantities and varieties of seed to produce based on the needs of farmers in their communities, ensuring that local voices are directly represented in food systems. AWAB will contract with 1,310 smallholder growers, 920 of whom are women, to produce the seed, which sells at an average 500 percent premium to grain, providing these farmers with a reliable, living income.

Shared Interest’s work benefits poor, “unbankable” borrowers who need larger amounts of capital than what is available from traditional microfinance institutions. This includes micro-entrepreneurs, smallholder farmers and farm cooperatives, and community groups. These borrowers would benefit from an investment, but for various reasons they are unable to obtain financing from local lenders. These reasons include lack of credit history, incomplete financials, or insufficient or unacceptable forms of collateral. Over the course of Shared Interest’s history, approximately 85 percent of the borrowers have been women.

Access to income is one of the most meaningful ways that women can achieve a measure of independence. This project will help hundreds of smallholder seed producers produce a living income through the cultivation of a crop which, for generations, men avoided because it was not seen as being financially lucrative. Being able to rely on AWAB to pay a fair price for their seed will enable these women to plan for their futures and invest in businesses, education, or other assets that will generate returns going forward. Another critical measure of self-sufficiency is the ability for women to borrow without a man as a co-signer or guarantor. Women in Africa rarely have access to the assets that are necessary to serve as collateral, such as real estate or land. In many cases women are legally prohibited from owning these assets. By receiving a Shared Interest guarantee, the women of AWAB will be able to borrow from a local bank and establish the credit history and banking relationships that will help their business thrive now – and into the future.

Access to income is one of the most meaningful ways that women can achieve a measure of independence. This project will help hundreds of smallholder seed producers produce a living income through the cultivation of a crop which, for generations, men avoided because it was not seen as being financially lucrative. Being able to rely on AWAB to pay a fair price for their seed will enable these women to plan for their futures and invest in businesses, education, or other assets that will generate returns going forward. Another critical measure of self-sufficiency is the ability for women to borrow without a man as a co-signer or guarantor. Women in Africa rarely have access to the assets that are necessary to serve as collateral, such as real estate or land. In many cases women are legally prohibited from owning these assets. By receiving a Shared Interest guarantee, the women of AWAB will be able to borrow from a local bank and establish the credit history and banking relationships that will help their business thrive now – and into the future.

This project is all-encompassing. Project implementation will focus first on establishing AWAB as an independent organization that produces a quality product, operates efficiently, and functions as a cohesive entity. AWAB will receive specialized support to build capabilities in financial management, create governance structures, and ensure legal viability. Members will be trained in entrepreneurship, negotiation, and other skills. AWAB’s growers will also receive training to increase their yields and ensure quality control, receiving instruction in agronomy and seed production.

The second major focus will be on the successful execution of AWAB’s business plan. Shared Interest will provide financial oversight and operational support for AWAB’s first season of seed production and distribution, to help ensure that volume and quality targets are met. The business plan cannot go forward unless AWAB can access working capital to purchase the seed produced by its growers, a challenge in the Malawian financial system, particularly for borrowers like AWAB. Shared Interest will help the organization obtain a loan by providing a guarantee for 75 percent of the loan value. After the seed is purchased, it will be graded, processed, and certified. It will then be sold directly to farmers through retail outlets in rural, underserved areas. AWAB will use the sales proceeds to repay its loan and invest in continued expansion of the business.

The specific steps Shared Interest will take to provide this level of support include:

- • Formation, structuring, and strengthening of African Women in Agribusiness (AWAB): Build cohesion between the nine seed micro-enterprises that are joining together to form AWAB; create and refine AWAB’s business plan; form the organization’s governing board; train members in business, management, and financial skills.

- • Preparation and training of growers: Provide agronomic training for AWAB’s growers. Training will focus on climate-smart agriculture to help maximize yields and ensure crop quality. Plan specific crops to be planted to align with AWAB’s business plan and distribute necessary inputs (including parent seed). With the onset of planting rains, AWAB growers plant crops.

- • Loan application process: Finalize governance and legal structures, assist with preparation of documentation, meet with lenders, navigate due diligence process, and prepare legal agreements needed for Shared Interest to provide letter of credit.

- • Preparation for harvest season: Secure warehouse space, processing equipment, and make hiring plans; identify locations for rural retail outlets where seed will eventually be sold.

- • Loan disbursement: Finalize loan and guarantee terms; negotiate terms for disbursement of cash and monitoring of stock; Shared Interest will provide collateral and AWAB receives funds.

- • Purchase of seed and initial operations: AWAB uses loan proceeds to buy seed from growers; seed is aggregated and transported to centralized warehouse locations; cleaned, graded, and processed, and stored until the selling season begins.

• Credit management and operational support: Begin financial and impact monitoring, including regular, detailed oversight of AWAB’s financial and impact data (including on-site inspection of operations) to ensure that the project is meeting its targets. This monitoring ensures that any problems are identified early, before default occurs, and when restructuring is still possible. This core activity also encompasses the ongoing mentoring that is designed to help AWAB gain the skills it needs to become operationally independent. By making use of a large network of supporting advisors in year one, AWAB’s members will build the skills needed to run a self-sufficient and sustainable organization.

• Credit management and operational support: Begin financial and impact monitoring, including regular, detailed oversight of AWAB’s financial and impact data (including on-site inspection of operations) to ensure that the project is meeting its targets. This monitoring ensures that any problems are identified early, before default occurs, and when restructuring is still possible. This core activity also encompasses the ongoing mentoring that is designed to help AWAB gain the skills it needs to become operationally independent. By making use of a large network of supporting advisors in year one, AWAB’s members will build the skills needed to run a self-sufficient and sustainable organization.- • Distribution and sale of seed: Identify rural locations for retail outlets and begin transporting seed to rented space in these villages. By operating its own locations, AWAB will be able to keep prices lower than they would if the seed were sold through existing retail channels. This distribution system will also enable AWAB members to target isolated communities that have been particularly cut off from access to seed and other inputs.

- • Loan repayment: Loan is repaid from sales of seed; business planning begins for next year’s planting season; final project impact measurement is conducted. Women of AWAB Malawi use the lessons learned from work so far to mentor AWAB Zambia, which is in development.

This project creates an alternative to the current seed system, which produces almost no seed for traditional crops grown by women. Nine women entrepreneurs will run a seed company serving smallholder farmers. By employing 920 female smallholder growers, these AWAB entrepreneurs will produce seed to supply 90,000 farmers with climate-resilient, nutritious legume seed at an affordable price. These employed growers will benefit from a reliable, increased income that will lift their families out of poverty. Finally, the project will establish a ‘bankable’ entity that can compete in the formal seed sector, paving the way for women-owned businesses to seek capital from mainstream lenders and proving that women entrepreneurs can succeed in the agriculture sector.

The project will directly serve the members of AWAB: 9 female entrepreneurs and their 1,310 smallholder farmers. These farmers live in nine districts in northern and central Malawi. They cultivate an average of 2.4 acres of land. Approximately 50 percent will suffer from food shortages during the hungry season. Almost all live on less than $1.90 per day. Approximately 70 percent (920) of these growers are female, so including the entrepreneurs of AWAB, the project will impact a total of 929 women and girls.

The project will directly serve the members of AWAB: 9 female entrepreneurs and their 1,310 smallholder farmers. These farmers live in nine districts in northern and central Malawi. They cultivate an average of 2.4 acres of land. Approximately 50 percent will suffer from food shortages during the hungry season. Almost all live on less than $1.90 per day. Approximately 70 percent (920) of these growers are female, so including the entrepreneurs of AWAB, the project will impact a total of 929 women and girls.

The project will indirectly affect a broader population of smallholder farmers living in the same districts: Lilongwe, Kasungu, Rumphi, Ntchisi, Dowa, Dedza, Salima, Nkhotakota, and Mzimba. The total population that will be impacted will fluctuate depending on the amount of seed that each farmer uses. Shared Interest’s estimate assumes that AWAB produces 1,830 tons of seed in year one, and each farmer purchases enough seed to plant a half-acre. Using these numbers, the project would indirectly reach 90,000 farmers. It is estimated that approximately 65 percent (58,500) of these farmers will be women, based on current legume planting patterns elsewhere in Malawi.

Although they will receive support, AWAB members – women entrepreneurs – are ultimately responsible for the organization’s governance and management decisions. They make up the governing board, giving them legal and fiduciary responsibility for the company’s operations, and will play a major role in negotiations with the lender. As the business owners, they have a meaningful stake in the project’s long-term success and will participate in program evaluation and identifying improvements that contribute to future sustainability. AWAB members also oversee the farmer networks that facilitate delivery of training, distribution of inputs, and production of seed. This structure creates a channel for the incorporation of local ideas, helping increase investment in the project’s long-term success.

Shared Interest’s long-term vision is for AWAB to become an effective competitor in the Malawian agribusiness space, acting as a pro-poor, pro-woman supplier in a market that currently does not produce goods or services for that segment. Given the incredible need for such a player, Shared Interest believes that with proper training there is significant opportunity for this organization to become an independent, sustainable, and profitable entity. The women entrepreneurs who make up AWAB have years of experience operating small businesses. They simply have never had the opportunity to truly thrive, largely due to lack of capital. Giving them access to these resources will allow them to evolve rapidly, seizing the opportunities in the marketplace. Similarly, AWAB’s smallholder growers also recognize the lucrative potential that growing seed presents for their families – not only a steady income, but prices that are a multiple of what they could earn growing other crops.

UN Sustainable Development Goals

![]()

![]()

![]()

![]()

Questions for Discussion

1. How do you think this project will affect the family dynamics of the women farmers?

2. What traits would you look for in the nine AWAB entrepreneurs?

3. How do you think this project will benefit the broader community, including the non-farmers?

How the Grant Will be Used

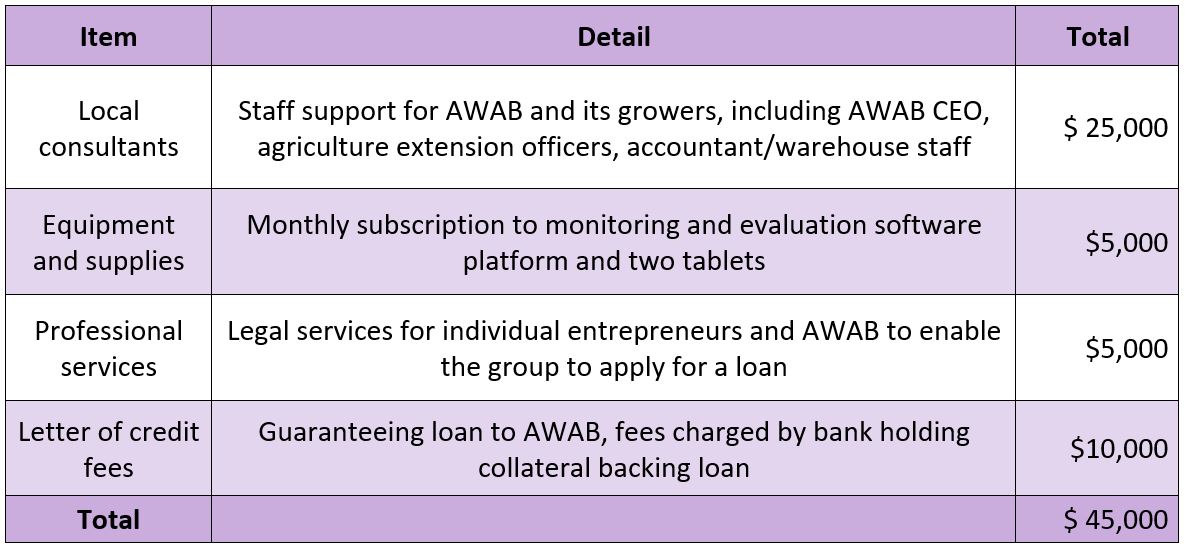

DFW’s grant of $45,000 for one year will be used for the following:

Why We Love This Project/Organization

We love Shared Interest’s focus on breaking the cycle of poor quality seed and its role in the “subsistence agriculture trap” that prevents many Malawian women farmers from lifting themselves out of poverty. By focusing on the availability of high quality seeds and loans from commercial banks, Shared Interest works to support a previously “unbankable” group of farmers towards higher incomes, sustainable futures, and healthier families.

Evidence of Success

Shared Interest has a four-star Charity Navigator rating. It has been selected six times for the ImpactAssets50, a list of select recommended impact fund managers achieving social and financial returns. Shared Interest has provided 70 guarantees worth a total of $28,816,000. These guarantees have resulted in loans worth more than $122,337,000, which have served more than 2 million total beneficiaries. These numbers include: 121,620 homes built as a result of Shared Interest financing, 1,936,940 jobs created by enterprises receiving Shared Interest guarantees, and 224,749 small and microenterprises assisted by capital unlocked by Shared Interest

Of the 70 borrowers, roughly 24 percent have borrowed again without a guarantee. Shared Interest calls this “graduating” or becoming bankable. This is one of the most valuable results a client can achieve. Shared Interest believes this number is artificially low, as some of their borrowers do not need to borrow again and would qualify for credit without a guarantee if they were to seek another loan.

Of the 70 borrowers, roughly 24 percent have borrowed again without a guarantee. Shared Interest calls this “graduating” or becoming bankable. This is one of the most valuable results a client can achieve. Shared Interest believes this number is artificially low, as some of their borrowers do not need to borrow again and would qualify for credit without a guarantee if they were to seek another loan.

Shared Interest has worked with 19 financial institutions, including large banks, insurance companies, pension funds, and community lending organizations. This is an important measure of the organization’s results, as it shows it has persuaded a broad spectrum of mainstream and non-traditional financial institutions to accept previously excluded borrowers as customers – and disburse loans to them – by using Shared Interest’s guarantee model.

Voices of the Girls

“If I get adequate income from farming, and when I do, I will spend the money on farm inputs to have a successful farming season. I also have a school-going child – I will pay school fees from the money, too.”

– Gelesta Yobu, AWAB farmer, East Dowa, Malawi

[Regarding delayed payment for the seed she has produced:] “We are anxious because we have to pay school fees and classes start in less than two weeks. I have five children in school. You know we women feel these things the most.”

[Regarding delayed payment for the seed she has produced:] “We are anxious because we have to pay school fees and classes start in less than two weeks. I have five children in school. You know we women feel these things the most.”

– Dorothy Amos, AWAB farmer, Ntchisi, Malawi

“Most of the smallholder farmers – more than 80 percent of them – are women in the very rural areas… They are not independent and have problems with their husbands…when they produce seed and they sell it, they do not have ownership of the cash that they get from selling their seed. They may wish to build a house, but they build it half-way because most of the cash was taken away by their husbands.”

– Stella Chuti, AWAB member and seed company entrepreneur, Lilongwe, Malawi

“I should have started working on my agribusiness in 2003, but I didn’t start until 2005, because my husband said, “No, no, no. If you obey me as your husband, don’t do this.’ So I obeyed him in 2004, but in 2005, I made a decision to do it. Then I found that my agribusiness was supporting our entire home, sending our kids to school, to college…”

– Martha Nkhoma, AWAB member and seed company entrepreneur, Lilongwe, Malawi

About the Organization

Shared Interest puts financial and social capital in the hands of a large group of women who would otherwise have limited access to these resources, helping them build wealth, accumulate knowledge, and exercise their collective power to influence agriculture value chains and local food systems. It takes place at the grassroots level and is owned and directed by women entrepreneurs and smallholder farmers, most of whom are living in extreme poverty.

Shared Interest puts financial and social capital in the hands of a large group of women who would otherwise have limited access to these resources, helping them build wealth, accumulate knowledge, and exercise their collective power to influence agriculture value chains and local food systems. It takes place at the grassroots level and is owned and directed by women entrepreneurs and smallholder farmers, most of whom are living in extreme poverty.

The organization was founded in 1994 by Donna Katzin, the organization’s current executive director. This was at the end of apartheid, to help drive re-investment in South Africa that would further the cause of economic justice. In 2011, the organization decided to expand to additional countries in the Southern African Development Community, initially Mozambique and eSwatini (then Swaziland).

Shared Interest provides the following services:

- • Loan guarantees and assistance with access to credit: Shared Interest helps borrowers who need larger amounts of capital than what is available from traditional microfinance institutions obtain credit from local financial institutions by guaranteeing their loans. It provides up to 75 percent of the collateral required by lenders in the form of a letter of credit, sharing the risk with local banks and moving these institutions to serve borrowers (like women in agriculture) that they otherwise would not.

- • Technical support and capacity building for borrowers: Before and during the borrowing process, Shared Interest and its local partners provide a variety of support services to each borrower. This ensures that the women can manage credit and that their business plans are sound. In addition to financial support, this assistance is often specialized or technical in nature, e.g., poultry production or operation of irrigation equipment, which underscores the importance of Shared Interest partners’ wide range of expertise.

- • Training and institutional development for banks: Shared Interest also helps borrowers by building local banks’ capacity to serve them. Shared Interest adapts underwriting standards, develops appropriate loan products, and implements risk practices. This allows lenders to adjust policies for this new type of customer, making it more likely these women will be able to borrow in the future without Shared Interest’s assistance.

There are other organizations focused on helping financially excluded individuals access small amounts of capital to invest in farms and microenterprises – such as Opportunity International, Kiva, Root Capital, Global Partnerships, VisionFund, Women’s World Banking, and many others. Shared Interest is unique in that it is working to help poor borrowers access larger amounts of capital – enough to support groups of farmers, grow small businesses into larger ones, and benefit entire communities. Another difference is that it works by using guarantees to move local banks to lend to their own communities. USAID’s DCA facility and the Swedish International Development Agency (SIDA) do provide large loan guarantees, but these rarely reach the types of “risky” borrowers that Shared Interest targets, and they are not accompanied by the tailored technical assistance that Shared Interest provides beyond the financial realm.

There are other organizations focused on helping financially excluded individuals access small amounts of capital to invest in farms and microenterprises – such as Opportunity International, Kiva, Root Capital, Global Partnerships, VisionFund, Women’s World Banking, and many others. Shared Interest is unique in that it is working to help poor borrowers access larger amounts of capital – enough to support groups of farmers, grow small businesses into larger ones, and benefit entire communities. Another difference is that it works by using guarantees to move local banks to lend to their own communities. USAID’s DCA facility and the Swedish International Development Agency (SIDA) do provide large loan guarantees, but these rarely reach the types of “risky” borrowers that Shared Interest targets, and they are not accompanied by the tailored technical assistance that Shared Interest provides beyond the financial realm.

Shared Interest’s model is fundamentally based on partnerships. Because it works with 5-15 different financial institutions at any given time – with borrowers in as many different industries – it is critical that Shared Interest work with a variety of partners who have the skills available to help manage those bank relationships and mentor the beneficiaries. Working primarily through on-the-ground partners helps keep overhead costs low and maximizes local knowledge. Partners allow Shared Interest to leverage impact many times over, by diversifying knowledge, linking to new communities in need of capital, providing resources needed to monitor risk, and measure impact.

Where They Work

Shared Interest serves five countries in the Southern African Development Community (SADC): South Africa, eSwatini (formerly Swaziland), Mozambique, Malawi, and Zambia.

Malawi is a landlocked country about the size of Pennsylvania that is home to 17.5 million people. It is in southern Africa and borders Zambia, Tanzania, and Mozambique. It has a democratic government and has been independent since 1964. Malawi is among the poorest countries in the world, although it has made economic progress in the recent past. Eighty percent of the population works in agriculture. The country is particular vulnerable to natural disasters, including cyclones, drought, earthquakes, flooding, and severe storms. Currently only 11 percent have access to electricity. Food insecurity is an ongoing concern.

Although half the population struggles with poverty, life for Malawians has improved. The fertility rate was 6.7 in 1992; today it is 4.4. Literacy is higher than many African nations, with 72 percent of men literate and 66 percent of women. Poverty is a result of low productivity in the agriculture sector plus few opportunities in other economic sectors, rapid population growth, and scant safety net programs. Unfortunately, corruption is an ongoing problem that sabotages efforts toward advancement.

A closer look at how women can become trapped in poverty because they cannot obtain credit

According to the World Bank’s 2014 Gender at Work report, “On virtually every global measure, women are more economically excluded than men.” Women in developing countries are less educated and less likely than men to have even the basics when it comes to their financial well-being. They are 20 percent less likely to have a bank account and 18 percent less likely to have borrowed money formally. In some cases, there are restrictions, such as needing a male family member’s permission to open an account. In some countries, even when an account is opened in a woman’s name, only a man can make decisions about the use of the funds.

According to the World Bank’s 2014 Gender at Work report, “On virtually every global measure, women are more economically excluded than men.” Women in developing countries are less educated and less likely than men to have even the basics when it comes to their financial well-being. They are 20 percent less likely to have a bank account and 18 percent less likely to have borrowed money formally. In some cases, there are restrictions, such as needing a male family member’s permission to open an account. In some countries, even when an account is opened in a woman’s name, only a man can make decisions about the use of the funds.

Some countries are trying to improve this situation. For instance, in Ghana, some bankers are helping women set up small businesses by offering micro-financing, or small loans. This may be due to the fact that some studies show that women are better at managing money than men. Of course, it is primarily the cultural, male-dominated norms that keep women anchored in poverty and away from the critical economic lifeblood of the economy: credit.

When women are excluded from financial decision-making or employment in general, there is a direct effect on their families and society. They receive up to half the pay as men. They are illiterate. They endure sexual violence. They are trapped in a life of servitude, regardless of the fact that many women in developing countries produce more food than men and bear the primary responsibility for feeding, sheltering, and educating their children. Their lower status is also reflected in their lack of access to education. It is a vicious cycle that can only be broken with intentional, well-crafted, proven strategies that provide the tools and support to rise up and participate in financial decision-making – and in the future of their community.

Source Materials

https://www.usaid.gov/crisis/malawi

https://www.worldbank.org/en/country/malawi/overview

https://www.cia.gov/library/publications/the-world-factbook/

https://www.economist.com/unknown/2001/03/08/the-female-poverty-trap

https://www.worldbank.org/en/results/2013/04/01/banking-on-women-extending-womens-access-to-financial-services