Mission

Women’s Microfinance Initiative (WMI) is a nonprofit organization run entirely by women who identified a need and found a smart microfinance solution that transcends the pitfalls of more traditional approaches. WMI eliminates middlemen, provides loans without collateral or interest, and provides training and support to ensure women stay in business. With its approach, WMI gets 100% repayments on loans. Repaid loans return to the loan pool for the next borrowers, thus making the loan process self-sustaining. Rather than continue to apply a top-down approach to alleviating poverty, WMI has developed a bottom up approach to changing the economic paradigm. With a small loan fund and a defined path to integrate women into the formal economy, WMI has created an environment for profound social change.

Life Challenges of the Women Served

In the three-country, remote areas of East Africa (Uganda, Kenya and Tanzania) where WMI operates, an estimated five million impoverished women are living in villages where they have no access to financial services. Over 90 percent of people in these developing countries are self-employed. Without access to financial services, these rural women have no opportunity to start a business to help their families. They and their families are mired in an unbroken cycle of economic isolation that condemns them to a subsistence existence.

WMI works in small agricultural villages where roads are dilapidated, distances are great, and transportation is expensive. There is no electricity. The economy is cash-based, with new borrowers reporting per capita income of less than $1.25 per day. Many WMI borrowers are AIDS widows, caring for 6 or more children, often not their own. They may be illiterate. They often live in mud-floored houses. Healthcare and sanitary living conditions remain an issue. Families have little savings for emergencies. Village women are extremely hard working, have strong entrepreneurship instincts and leadership qualities, and work cooperatively together. Though not formally educated, they are natural businesswomen: intuitive, innovative, market savvy and able to adjust quickly to changing market conditions and opportunities.

Traditional aid organizations generally bypass the rural areas where WMI works because of the remoteness, lack of infrastructure and high cost of distributing services.

The Project

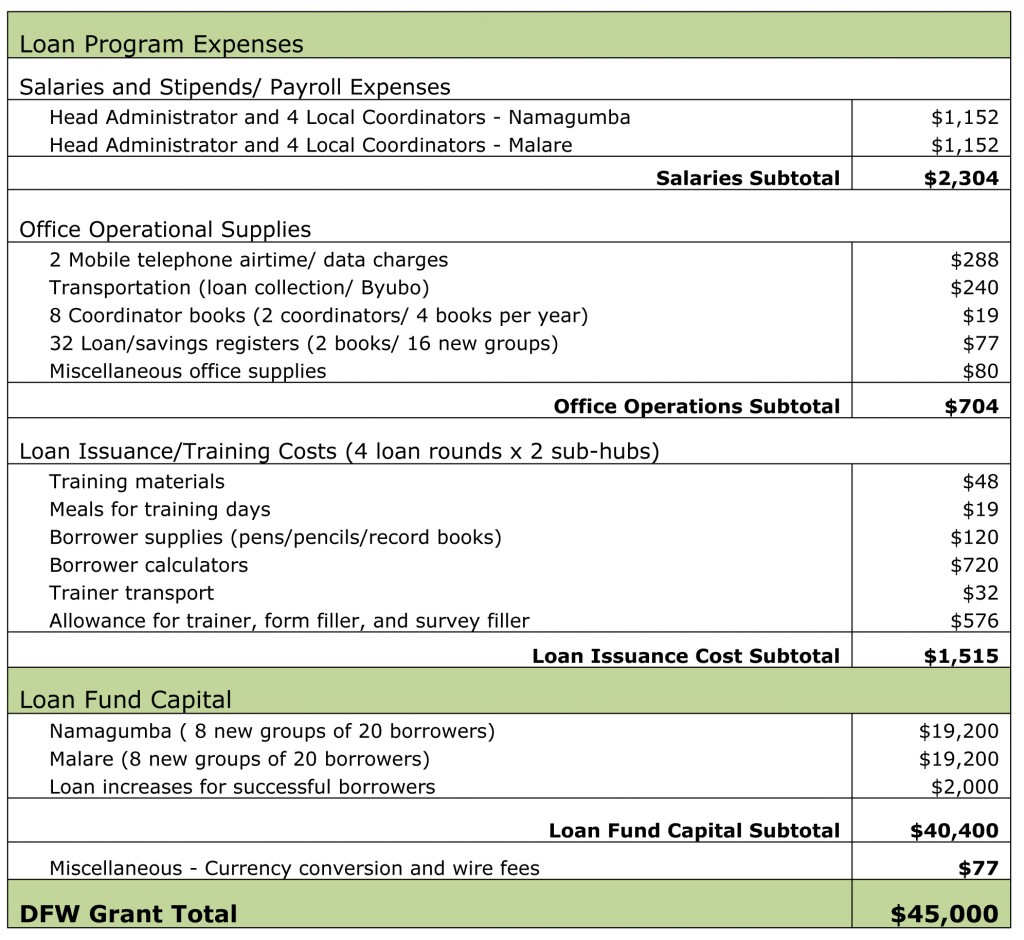

The expansion of the Buyobo loan program will serve up to 320 women in two year cycles. Repaid loans will be lent to another group of 320 women. The indirect impact is estimated to be at least 2,300 villagers including immediate family, extended family, business suppliers, and potential employees. DFW’s grant will pay for salaries/stipends, operational supplies, loan issuance/training costs, and capital for the loans.

The impact of the program is impressive

- Increasing economic opportunity and empowerment.

- Providing a financial system that is rule based, predictable, and non-discriminatory through a fair micro-credit service that provides the training and credit history necessary to enable its rural women borrowers to easily transition to regulated banking.

- Promoting social change and gender equality, including a reduction in domestic violence and child mortality, improved maternal health and reduced HIV/AIDS, malaria and other disease.

- Working to eradicate extreme poverty and hunger, especially in areas ravaged by a long history of war and violence.

- Increasing business skills and leadership roles through its women-run organization.

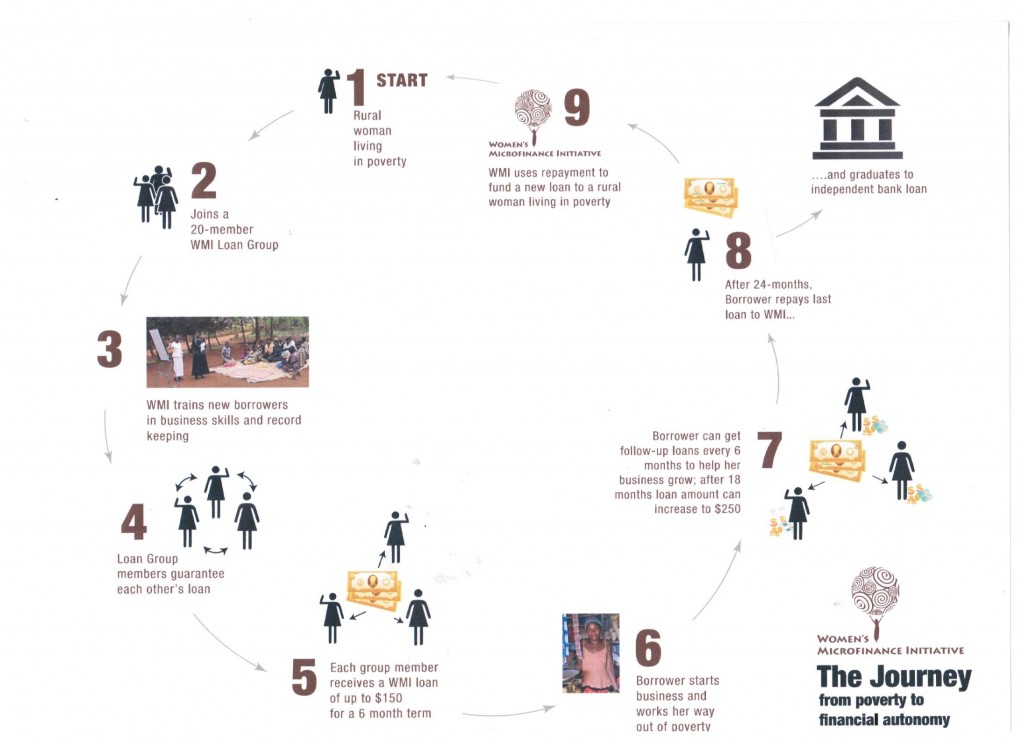

The loan program is composed of four key components:

- Loan Fund: The WMI loan fund provide four successive collateral-free interest-bearing, six-month term business loans ranging from $50 to $250.

- Training: WMI’s local staff, all loan program graduates trained by WMI, is on the cutting edge of peer-to-peer knowledge transfer protocols. The WMI trainers from Buyobo travel as far as central Kenya, southwest Uganda, and Tanzania to bring business skills to rural women. Training by women who have successfully graduated from the program and are successful businesswomen themselves is a powerful training component.

- Peer Group Support: Borrowers are organized in 20-member solidarity groups. They cross-guarantee each other’s loans, harnessing the powers of peer persuasion and group solidarity. The groups meet bi-weekly to share skills and knowledge, and they are mentored by more experienced business-women. They are provided on-going record-keeping and business training and other support to improve their businesses.

- Graduation: The women graduate from the program after two years when they have repaid their loans. They become financially autonomous with skills and experience to successfully manage a business. They are eligible to bank at a regulated commercial bank under favorable terms with WMI’s underwriting for one year.

Questions for Discussion

- DFW has funded several microfinance programs in the past 11 years. What do you think makes WMI and many of the other programs suitable for DFW grants?

- Discuss the benefits of the four key elements of the program: loan fund, training, peer group support, and graduation.

- The graduation ceremonies for the WMI program are large celebrations that involve music, singing, a parade, and involvement by the entire community. What are the ways in which the community is affected by WMI?

How the Grant Will be Used

DFW’s grant of $45,000 over one year will help fund a permanent, revolving loan fund that will initially help 320 women, but after two years when the women graduate and repay their loans, the funds will be re-lent to another 320 women. The cycle will continue indefinitely.

Why We Love This Project/Organization

We love this program because it is an all-woman organization that successfully supports women toward financial independence. WMI delivers a triple bottom line: women are given the means to operate sustainable businesses, they become empowered as community leaders, and banks change the way they deal with rural women, admitting them to the formal banking environment. Promising participants in the programs may become staff members. Further, domestic violence is reduced because WMI encourages women to involve their husbands and family members in the business, and women gain respect in both the household and the community when they are proven money-earners. As a woman’s financial circumstances improve, she is not only better able to feed, clothe, and educate her families, but she is also able to save for emergencies. Families are healthier and happier. Children are educated and the cycle of poverty is broken.

Evidence of Success

In the years since WMI launched its first loan group, more than 30 loan groups have been launched. Beyond

the success of the loans, there are additional signs that women are enjoying higher status in their communities as reported by Olive Wolimbwa, WMI in-country director:

- WMI graduates are beginning to buy land and build permanent houses.

- They are opening bank accounts and using ATM cards.

- Domestic violence has been reduced.

- Loan hubs are thriving in areas recovering from insurgency fighting.

- Women are increasing their collective business acumen as they pass skills on to their peers.

- They are becoming leaders within their communities.

From WMI records, only 11 percent of borrowers had a family income of more than $1,000 a year when they entered the loan program. Over 72 percent of borrowers reported the family income was more than $1,000 a year after just six months in the program. At six months into the program, 95 percent of borrowers reported a healthier family; 78 percent reported feeling more determined; and 70 percent of borrowers reported improved literacy and numeracy skills.

Voices of the Girls

About the Organization

Robyn Nietert and a group of Washington DC area businesswomen founded WMI in 2007. The organization provides comprehensive village-level microfinance and training to women in rural East Africa with a sustainable program that the women run themselves. WMI is not a big bank or large corporation, but a group of businesswomen on one side of the globe helping their counterparts on the other. An important advantage of a microfinance initiative is that, unlike conventional aid programs, microfinance preserves the capital base of an organization by providing loans rather than subsidies.

Where They Work

WMI works with women on a village-level scale in remote rural areas of East Africa (Uganda, Kenya and Tanzania) that have primarily agricultural-based economies. Buyobo is an administrative sub-county in east Uganda near the Kenyan border on the slopes of Mount Elgon. Inhabitants support themselves by mixed farming, growing crops like bananas, maize, beans, and cassava. They also raise cattle, goats, chickens, and turkeys, along with a smaller number of sheep. In addition to basic subsistence farming, they grow coffee as a cash crop and engage in commercial activities connected with the nearby town of Mbale.