Microfinance: The next generation

— Muhammad Yunus, founder of the Grameen Bank

By Marcie Christensen

After a famine in Bangladesh in 1974, Muhammad Yunus, a professor of economics at Chittagong University, wanted to do something for poor people in his country. While talking with some local women, he learned they were paying high interest rates on very small sums they borrowed to fund their craft businesses. He gave 42 of them a total of $27 from his pocket to solve their problem. They used the funds to free themselves from the loan sharks, and were able to pay him back. His experience with these loans, and his belief that the poor can lift themselves out of poverty if given the opportunity, led him to found the Grameen Bank in 1976. He coined the term ‘micro-credit’ to describe small, long-term loans on easy terms.

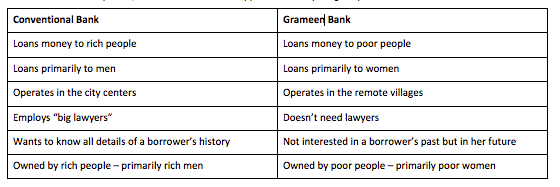

In a compelling 2012 TEDx talk in Vienna, Yunus spoke about the history of microfinance and how he came to decide on the process and structure of the Grameen Bank. He said it was relatively simple. He just “looked at the ways conventional banks operate, and decided to do the opposite of everything they did”.

When Professor Yunus and the Grameen Bank were awarded the Nobel Peace Prize in 2006, more than seven million borrowers had been granted such loans, on average borrowing $100 each. More than 95 percent of the loans went to women or groups of women. Three decades of experience extending small loans to the poor has convinced Yunus that loans to women offer the most benefit for borrowers’ families as well as the best security for the bank. By 2014, there were 8.6 million members, 97 percent of whom were women.

The 16 Decisions

- In exchange for microcredit, the Grameen Bank does not ask for a credit history, collateral, or even for loan group members to guarantee one another’s repayment. Instead, borrowers are asked to commit to what are known as the ‘Sixteen Decisions’, thus incorporating elements of social change into their communities:

- We shall follow and advance the four principles of Grameen Bank: Discipline, Unity, Courage and Hard work – in all walks of our lives.

- Prosperity we shall bring to our families.

- We shall not live in dilapidated houses. We shall repair our houses and work towards constructing new houses at the earliest.

- We shall grow vegetables all the year round. We shall eat plenty of them and sell the surplus.

- During the planting seasons, we shall plant as many seedlings as possible.

- We shall plan to keep our families small. We shall minimize our expenditures. We shall look after our health.

- We shall educate our children and ensure that they can earn to pay for their education.

- We shall always keep our children and the environment clean.

- We shall build and use pit-latrines.

- We shall drink water from tubewells. If it is not available, we shall boil water or use alum.

- We shall not take any dowry at our sons’ weddings, neither shall we give any dowry at our daughters’ weddings. We shall keep our centre free from the curse of dowry. We shall not practice child marriage.

- We shall not inflict any injustice on anyone, neither shall we allow anyone to do so.

- We shall collectively undertake bigger investments for higher incomes.

- We shall always be ready to help each other. If anyone is in difficulty, we shall all help him or her.

- If we come to know of any breach of discipline in any centre, we shall all go there and help restore discipline.

- We shall take part in all social activities collectively.

Over the past decade, Dining for Women has funded many programs that incorporate microfinance in their projects to empower women and girls. From Village Enterprise (March 2006) to Women’s Microfinance Initiative (December 2014), these programs have all included training and skill development to maximize the success women can achieve with borrowed funds. Our May 2013 Food for Thought article – Weaving an Entrepreneurial Future – provides an overview of microfinance along with a look at a growing number of innovations in finance and money-management for the poor.

Grameen expands globally

The Grameen Bank has grown into more than two dozen enterprises globally, from social businesses developing software, fabrics, and phones to savings and loan institutions in Asia, Africa, and the Americas. Grameen America, founded in 2008, offers women microloans, savings, training, and support to transform communities and fight poverty in the United States. There are six Grameen branches in New York and five in other cities, including Los Angeles, Omaha and Charlotte, N.C. Borrowers form groups of five, approve one another’s loans and make weekly payments at 15 percent annual interest. Most borrowers, Grameen reports, repay their debt and become repeat customers. Borrowers are also given savings accounts and encouraged to save at least $2 a week. Grameen America has been reported on by The New York Times and The Economist.

Challenges to microcredit

The success of the Grameen Bank, and microcredit as Muhammad Yunus envisioned it, has been threatened in recent years by a number of challenges.

Some enterprising businessmen, seeing the profit that could be made from lending to the poor, entered the arena and tarnished the original concept of microcredit by charging ever-increasing interest rates to create greater profits for investors.

In 2010, a Danish documentary – “Caught in Micro-debt” – accused Yunus and Grameen Bank of funneling Norwegian aid money into a partner company. The Norwegian government exonerated them of the charge and the Norwegian Nobel Committee reasserted its support.

Yunus was forced out of Grameen Bank in 2011. Government representatives said Yunus, who was 72 at the time, violated a law that requires all citizens to retire at age 60.

The Grameen Bank Commission, in 2013, recommended three options to radically restructure the Bank. The first would give majority control of the Bank to the Government of Bangladesh instead of allowing it to remain governed by its borrowers, the majority of whom are poor women. A second option would turn the Bank into a private company. The third option would break the Bank apart into 19 separate entities with no legal relationship between them. Critics argued that any of these recommendations would destroy the bank’s independence and undermine its original shareholders. Matters are still not settled, as the government gave the Bangladesh Bank (BB) authority to form a commission to elect nine directors of the 12-member board, but the BB declined to proceed, citing conflict of interest as they are a regulatory body.

– Muhammad Yunus, Huffington Post, Jan. 23, 2014

The future of microfinance

In February 1997, RESULTS Educational Fund convened the first Microcredit Summit, launching a nine-year Campaign to reach 100 million of the world’s poorest families, especially the women of those families, with credit for self-employment and other financial and business services by the end of 2005. This historic event, held in Washington, DC, brought together more than 2,900 delegates from 137 countries. Since then, the Microcredit Summit Campaign has been leading, supporting, and guiding the microfinance field to address failures in reaching the very poor. The success of the first phase of the Campaign, during which those with microloans grew from reaching 7.6 million of the world’s poorest families in 1997 to more than 100 million in 2007, fueled the decision to extend the Campaign.

The Campaign has four core themes that focus not only on the number of clients reached but also on the quality of the practitioners’ work:

- Reaching the Poorest

- Empowering Women

- Financial Self-Sustainability

- A Positive, Measurable Impact

The 17th annual Microcredit Summit, held in September 2014 in Mexico, focused on the theme Generation Next: Innovations in Microfinance. While microcredit was touted by some as ‘the magic bullet’ to end extreme poverty, stakeholders in the movement for financial inclusion now embrace the goal of encouraging the delivery of a full range of financial products at fair prices and without the risks poor people face today.

What is financial inclusion?

The goal of financial inclusion is to develop financial markets that responsibly serve more people with more products at lower cost. Financially inclusive markets comprise a broad, interconnected ecosystem of market actors and infrastructure delivering financial products safely and efficiently to low-income customers. These market actors may include banks, financial cooperatives, e-money issuers, payment networks, agent networks, insurance providers, microfinance institutions, and more.

What began as the provision of loans to poor people for the purpose of building microenterprises has evolved into a global effort to provide poor people with access to a range of financial products and services. Research and experience demonstrate that, in addition to using credit, low-income people save, make payments, use insurance, and make use of a variety of other tools to manage their complex financial lives. Financial inclusion efforts seek to make these and other products available to everyone in a safe, cost effective, and convenient manner.

– Muhammad Yunus, Sacrificing Microcredit for Megaprofits, The New York Times, Jan. 14, 2011

- About Microfinance

- TEDx talk by Muhammad Yunus

- Social Business and the Pursuit of Happiness by Muhammad Yunus

- Microfinance Gateway

- To Catch a Dollar, a 2010 documentary on the process of establishing the Grameen America in Queens, NY

- State of the Microcredit Summit Campaign Report